Best Live Crypto Signals for Free

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

We have compiled a list of top crypto signal sources based solely on publicly available information from the providers. However, we have not independently verified their authenticity and cannot guarantee that the stated promises correspond to reality. It is important to understand that such offers often fail to meet expectations. We strongly advise using crypto signals only on trusted platforms such as Bybit, MEXC and OKX, where signal providers are internal participants, and the statistics are transparent and trustworthy. These companies value their reputation and minimize risks.

TOP Free Crypto Signals:

- OKX - Best automated trading solutions (copy trading, easy bot integration)

- Kraken - Best for trading crypto-fiat pairs (supports 7 fiat currencies, simple trading platform)

- CoinMetro - Suited for conservative trading (simple UI and low leverage of up to 1:5)

- Cryptohopper - Best for bot trading (highly customizable settings, support of major exchanges)

- Bitunix - Global crypto derivatives exchange offering spot and futures trading with up to 125x leverage

Crypto signals offer a great opportunity for earning a profit in the cryptocurrency market, principally for the following three reasons:

- High level of price action, which presents more substantial trading opportunities. The average daily trading range for Bitcoin is up or down in price by approximately 3.5%; for comparison, the prices of the majority of stocks only fluctuate up or down by approximately 1% on average.

- Diversity of coins and cryptocurrency pairs. A large variety of tradeable assets also means more trading opportunities.

- Round-the-clock operation of the markets is another characteristic of the cryptocurrency market that translates to more good trading opportunities.

You can find the full list of cryptocurrency signal providers in the review.

What Are Crypto Trading Signals?

Crypto signals are recommendations to enter (or close) a trade on cryptocurrency assets. The signals are sent via different methods from professional traders and strategy developers to individual investors, with the purpose of gaining mutual benefit.

Some signals are free, while others are quite expensive. Some signals show suspiciously high profitability. In short, there are many signal providers. How do you choose the best crypto signals service? How can you avoid missing important details? In this article, we tell you all about using cryptocurrency signals services, by examining seven of the best crypto signal providers.

Top Crypto Signal Providers

Our review of the top seven crypto signal providers looks at the pros and cons of each service, to help ensure that you use your investment capital in the best possible way. Ultimately, the decision to invest is yours alone and you are solely responsible for your equity.

| Crypto Signals Provider | Platform | Markets | Terms of Use |

|---|---|---|---|

| Bybit | Copy trading | Bitcoin, Crypto futures, altcoins | Free |

| OKX Signal Trading | Copy Trading | Bitcoin, Altcoins | Various |

| ZIGDAO | ZIGDAO | Bitcoin, Altcoins | Free basic account |

| 100 eyes | Telegram | Bitcoin, Altcoins | Free + Premium |

| Cryptohopper Signals | Copy Trading | Bitcoin, Altcoins | Free + Premium |

| Stoic AI | API Signals | Altcoins | 5% Fee |

ByBit - Derivatives Copy Trading Signals

Bybit currently offers Copy Trading on both Spot and Derivatives. The goal of Bybit's copy trading platform is to provide Followers and Master Traders with a lucrative trading environment.

Copy Trading adjusts Master Traders and their followers' trades synchronously. After the Follower picks a Master Trader and establishes the copy order settings, all new corresponding copy trades positions or orders started by the Master Trader will be automatically copied to the Follower's account with the market order.

Also Bybit offer several AI-powered solutions for traders. AI integration unlocks real-time market signals, empowers traders with automated strategies boasting an up to 80% win rate.

The TradeGPT Master Trader is automatically mirror expert algorithms' moves with an 80% reported win rate, sentiment insights, and quantitative strategies.

TradeGPT AI Assistant interprets market data, recommends analyses, and answers your investment questions with AI and a 200k+ community.

Aurora AI Bot backtests and recommends optimal trading strategies based on historical data, making complex options accessible to all.

- Pros

- Cons

- Spot and derivatives are available

- Very high derivatives liquidity

- No extra fees on the exchange’s side

- Free spot trading

- Lot of pro traders to follow

- Strategy providers may send signals with high risk scores

- It is necessary to carefully select and check the signal provider. It is worth starting with a small deposit

OKX Signal Trading

OKX Signal Trading makes cryptocurrency trading easier by providing real-time trading signals crafted by experts. Both beginning and experienced traders can benefit from this service, which simplifies complex market analysis into clear trading ideas. Users have the flexibility to select from various expert signal providers based on their preferred strategies and risk tolerance levels. The Signal Bot tool also allows creating customized signals, giving traders more autonomy.

The service aims to automate the process of copying signals directly into users' OKX accounts. This allows seamless and secure integration with over 600 tradable cryptocurrency pairs across spot and derivatives markets. Robust liquidity and trading volumes on the OKX platform further support this effort.

Signal providers can monetize their skills by offering paid subscription or performance-based fee models. Their signals will be automatically copied by subscribers.

- Pros

- Cons

- Removes guesswork by leveraging other’s knowledge.

- Sets and forgets with automated trading.

- Allows customizable strategies using the Signal Bot.

- Opportunities for skilled traders to generate income.

- Integrates securely with a reputable exchange.

- Performance depends on the signal provider so gains aren't guaranteed.

- Subscription costs cut into profits.

- Automated copying gives users less control over trades once started.

- Success relies on selecting high-quality signals.

Bitcoin Signals on ZIGDAO

ZIGDAO, formerly known as Zignaly is one of the best Bitcoin signals trading services that you can find for free at the moment. ZIGDAO is completely free to use - although the platform does offer paid premium memberships and add-ons if traders want to access them. Still, the free signals from ZIGDAO have worked wonderfully in the past.

ZIGDAO is quite popular because it’s cheap, unique, and easy to access. Traders on ZIGDAO can easily follow analysts and engage in copy trading. It’s totally free to sign up, but keep in mind that some analysts and traders require fees to connect with them.

Important Features:

Web-based signal type

Offers a trading bot that supports Binance, BitMEX, and KuCoin

Customer service support is excellent and multilingual

Profit-sharing options

- Pros

- Cons

- There are a ton of different signal providers, there’s little opportunity for fraud, signal accuracy is visible to everyone, and there is a lot of educational content available as well.

- Notification frequency is inconsistent; many analysts and traders charge a fee for subscriptions to their signals.

100-eyes Crypto Trading Signals

This signal provider is a company from the Netherlands, which developed its own proprietary crypto market scanner. The scanner monitors different crypto assets, analyzing their price action over different timeframes and then sends signals discovered by using technical analysis via Telegram.

- Pros

- Cons

- Wide coverage of markets – over 189 crypto pairs

- Free crypto signals are available

- You can get discounts through registration on referral links

- By executing trades based on signals manually, you can control your account, and choose to only act on the signals when you agree with

- Low fee for premium status – only $100 per year

- Premium users can set criteria so that they only receive signals on the specific markets and timeframes that they want to trade in

- The signals are provided based on technical analysis rules. A signal may be generated by using a classical technical indicator (for example EMA, MACD). Because such indicators often generate many false trading signals, the value of the service is questionable.

- There are no detailed statistics provided on the profitability of past signals

Cryptohopper Signals

Cryptohopper is a platform of signals for the cryptocurrency market. It was founded in 2017 by two Dutch Brothers Ruud and Pim Feltkamp on the wave of Bitcoin reaching USD 20,000. Around 300,000 clients use the platform; it is possible to receive free signals; independent trading with connection to different crypto exchanges is available.

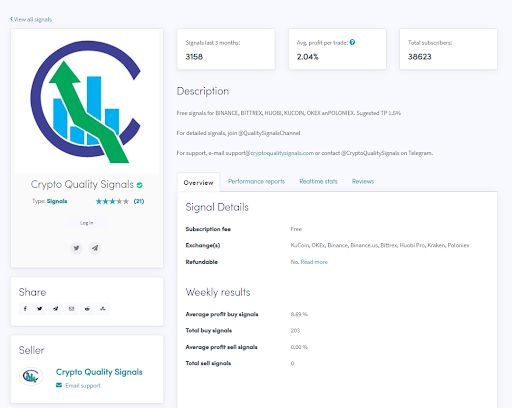

The platform provides an opportunity to copy crypto signals from over 100 providers to your account. Let’s see the possibilities the signal from the most popular provider with more than 38,000 subscribers opens.

3,000 signals, each of them bringing +2%? That’s amazing. Then why do the subscribers only give the provider three stars out of five? It is because of the non-transparent methodology of calculation of the signal profitability.

- Pros

- Cons

- Wide choice of crypto signal providers

- There are free and paid signals

- Proprietary copying service

- Unclear calculation of signal profitability

- There are no detailed statistics for each signal, which would make it possible to see maximum drawdown, for example.

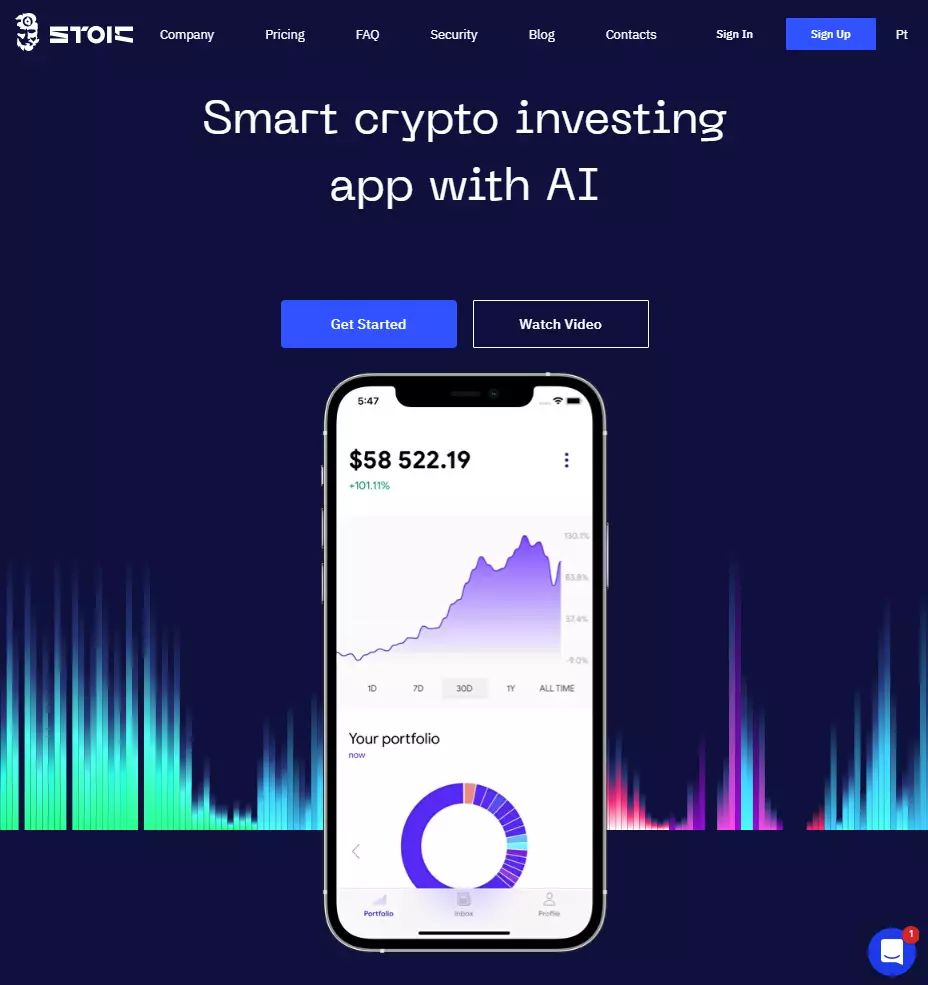

Stoic AI - Crypto Signals Review

These signals are provided by Cindicator, a company that was established in 2015. The signals are based on artificial intelligence (AI), which processes opinions of hundreds of different analysts.

The company has around 10,000 clients with USD $100 million in their accounts.

- Pros

- Cons

- High profitability is promised

- The provider provides signals for different pairs

- Modern interface, it is very simple to connect

- You can set up signals in such a way that not the entire portfolio, but only its percentage is involved. You can keep part of it as insurance.

- Responsive customer support

- Minimum deposit is USD $1,000

- The only signals provided are signals to buy cryptocurrencies. When, the crypto market is in a bearish phase, signal subscribers are likely to incur losses. For example, in Q2 2024, when BTCUSD plunged from 60K to 30K, the loss on buying Bitcoin was -40%

- It is only possible to connect via the Binance exchange

Can I Get Free Signals Directly From My Crypto Exchange?

Alerts: Many crypto exchanges allow you to set up price alerts. These can notify you when a cryptocurrency reaches a certain price level or when there are significant changes in market conditions.

Signals from automated trading bots: By connecting your account to these bots, you can receive signals and execute trades automatically.

Technical analysis tools: many exchanges offer built-in technical analysis tools and charts. These can help you identify trends and patterns in the market, providing insights that can inform your trading decisions.

Signals on platforms like TradingView: Some exchanges integrate with TradingView, allowing you to use TradingView's advanced charting and analysis tools as well as automated signals from indicators. You can follow trading signals and ideas from the TradingView community, integrating these insights directly into your trading strategy.

| Copy trading | Alerts | TradingView | Trading with bots | Open account | |

|---|---|---|---|---|---|

| Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | Open an account Your capital is at risk. |

|

| Yes | No | Yes | Yes | Open an account Your capital is at risk.

|

How to Choose The Best Signal Provider

At first glance, profitability should naturally be the key criterion for choosing a crypto signal provider. The more money the crypto signal brings, the better, right?

Risk setting. Higher profitability almost always means higher risk. Review the history of drawdowns of the signal provider, if it’s available.

Signal stability. For how long does the signal work? If it brought +50% during just one month, it could have been simply a consequence of the market being in the stage of a strong uptrend.

Possibility of using a demo account. It helps to be able to test how well the signals work before connecting a real account.

Company reputation. What do people say about it online, what are the reviews? In which jurisdiction is the company registered, its regulation, audit? Transparent answers to these questions will help ensure that the crypto signal provider is trustworthy.

Most importantly, always keep in mind that success in the past does not guarantee profit in the future. This statement can be found on many websites, but it is important to reiterate it once again.

Crypto Signal Platforms

The method of delivering signals is a special criterion that will help dismiss many ‘candidates’. Personal preferences and circumstances are the defining factors in this.

How do you see signal processing in general?

Can you check the signals personally and execute them manually? Having manual control can be a plus, but it also means that you may miss entering what turns out to be a profitable trade at the best possible price/time. A pause between the signal and the execution could lead to a serious deterioration of the final result.

Or maybe you want to fully automate the process? In this case, you will have less control over the signals, but higher speed of execution.

Copy Trading Signals

Some large providers work to develop their proprietary platform in order to ensure the best connection between the signal providers and investors. In this case, it is possible to set up full automation and achieve high speed.

Telegram Crypto Signals

Telegram is a messaging application that is popular among both investors and signal providers in the cryptocurrency market. You can find both paid and free channels providing crypto trading signals and anonymous groups that are organizing pumps and dumps.

Twitter Crypto Signals

Twitter is a popular social network. Many politicians, athletes, and artists have their own accounts on Twitter. Investors and cryptocurrency enthusiasts are no exception. Here, you can potentially reach a wide audience and find clients. The network is relatively accepting of cryptocurrencies, which is why sources and re-broadcasters of signals for the crypto market actively promote themselves on Twitter.

Discord Crypto Signals

Discord is an alternative to Telegram. Communities for organizing pumps and dumps are often created on the platform, which is designed for communication of gamers.

Discover the best TikTok crypto signals for real-time trading insights and market updates.

How to Use Free Crypto Signals

For newer traders, it's essential to carefully evaluate each signal before acting on it. Here's a step-by-step approach for analyzing and interpreting free crypto signals:

Evaluate the signal's clarity and completeness

An actionable signal should specify the crypto pair (e.g., BTC/USDT), the trade direction (long/short), the entry price or zone, take-profit price targets, stop-loss price, and position sizing (as a % of account balance).

Check if the signal includes a clear invalidation point - the price level at which the trade setup is no longer valid.

Be wary of signals with vague entry instructions like "buy the dip" without specific levels, or take-profit targets that seem far-fetched relative to the stop-loss.

Assess the risk profile

Look at the distance between the entry price and the stop-loss level. A stop-loss that's very close to entry may result in frequent small losses, while one that's too far away implies smaller sizing.

Check what percentage of your account balance the signal suggests risking on the trade. The risk of 1-3% per trade is a common guideline, while anything over 5% is generally considered aggressive.

Confirm that the signal's risk/reward ratio (potential profit divided by potential loss) is at least 1.5:1, and preferably 2:1 or higher, for a favorable statistical edge.

Ensure timeframe compatibility

Intraday signals with targets hit within a few hours suit day traders who can monitor positions actively. Swing trade signals that play out over days are better for those unable to watch the markets constantly.

Align the signal's timeframe with your available trading capital - numerous shorter-term trades may require a larger balance to absorb volatility.

Look for confluence

See if the signal aligns with basic technical analysis principles like trading in the direction of the trend, or buying near support/selling near resistance.

Compare the signal to your preferred indicators (e.g., moving averages, RSI, MACD). Confidence is higher if there's agreement between the signal and your own analysis.

Check crypto news sites and social media for any news catalysts that could support or invalidate the signal's reasoning.

Consider the market context

Assess if the signal is in harmony with the broader market's price action and sentiment. A long signal in a crypto that's seeing a high-volume breakdown on its chart amidst negatively received news is riskier than one in a steadily climbing crypto with bullish news flow.

Take into account crypto market correlations. If Bitcoin is dumping hard, a long altcoin signal may be less reliable as most cryptos tend to follow BTC.

Try to avoid common mistakes

Changing parameters. Tweaking signal filters/strategies usually just chases ghosts in the data. Backtests are done as-is and changing parameters compounds errors.

Revenge trading. If invalidated, accept signals that were wrong and walk away. Re-entering loses discipline and compounds initial errors into bigger mistakes.

Not tracking results. Without metrics, it's impossible to know what's working and what needs improvement. Log, analyze, and optimize proven strategies.

Failing to diversify among different strategies and signal providers. Relying on any single source of advice goes against sound money management practices.

Fomo entries. Chasing pumps minutes after signals results in poorer entries. Wait for retests and confirmation rather than fear of missing out.

Remember, no signal is guaranteed to be successful, no matter how strong it looks. Always use stop-losses and never risk more than you can afford to lose. Aim to develop your own market analysis skills over time, using free signals as a learning aid rather than a crutch.

Expert Opinion

As a beginner trader venturing into the volatile world of cryptocurrency, it's essential to have reliable guidance.

Our recommendation for beginners is to start by following a few reputable signal providers from the list. This will give you a sense of the market without the need to deeply understand the complex analysis behind each trade. However, always approach these signals with a critical mind. Verify the track record of the signal providers and remember that no one can predict the market with absolute certainty.

Diversify your sources and never rely on a single signal provider. Combine the insights you gain from these signals with your own research and continuous learning. This balanced approach will help you develop your trading skills and build a robust strategy for navigating the crypto markets. Remember, in trading, knowledge is as valuable as capital.

FAQs

Are free crypto signals reliable?

Free crypto signals can be hit or miss in terms of reliability. Paid signal services from reputable providers generally provide higher quality signals. But free signals still allow you to evaluate a provider’s performance.

How often are crypto trading signals sent out?

Signal frequency varies between providers. Some send multiple intraday short-term signals, while others stick to 1-2 longer term signals per week. More frequent signals usually come with paid memberships.

Can I make money using free crypto signals?

It's possible to profit off free crypto signals, but paid signal subscriptions have a higher success rate. Use strict risk-management, and you could still profit even with a free signal service's lower accuracy.

Can I get scammed using crypto signal services?

Unfortunately, yes. Do research on reviews and community feedback for signal providers before subscribing. Never provide API access to your exchange account or wallet to an untrusted signal service.

Related Articles

Team that worked on the article

Johnathan M. is a U.S.-based writer and investor, a contributor to the Traders Union website. His two primary areas of expertise include finance and investing (specifically, forex and commodity trading) and religion/spirituality/meditation.

His experience includes writing articles for Investopedia.com, being the head writer for the Steve Pomeranz Show, a personal finance radio program on NPR. Johnathan is also an active currency (forex) trader, with over 20 years of investing experience.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.